Previously companies needed to acquire physical premises and infrastructure to start their business. There was a substantial up-front cost in hardware and infrastructure to start or grow a business. Cloud computing provides services to customers without significant upfront costs or equipment setup time.

These two approaches to investment are referred to as:

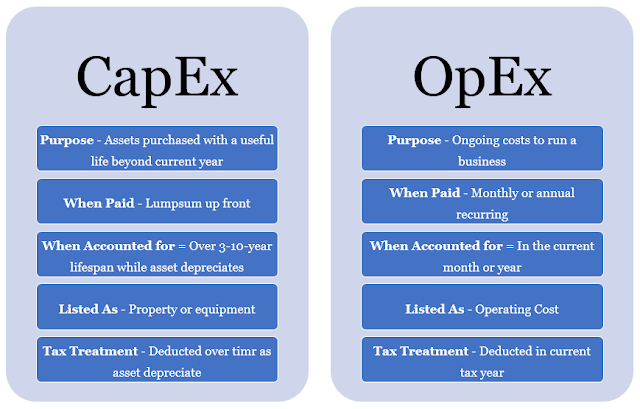

Capital Expenditure (CapEx): CapEx is the spending of money on physical infrastructure upfront, and then deducting that expense from your tax bill over time. CapEx is an upfront cost, which has a value that reduces over time.

Operational Expenditure (OpEx): OpEx is spending money on services or products now and being billed for them now. You can deduct this expense from your tax bill in the same year. There's no upfront cost. You pay for a service or product as you use it.

|

Companies typically needed capital expenditure to benefit their operations or a fixed asset’s mass benefits

ReplyDelete